School Superintendent (more ...)

County Executive (more ...)

Meals Tax Task Force (more ...)

Meals Tax Pamphlet (more ...)

A June 5 Fairfax County Taxpayers Alliance email to the Fairfax County Office of Public Affairs asked, "... how much of the meals tax revenues would be used for raises and benefits?" The June 6 reply cited the 70/30 allocation between the schools and county and stated, "More specific uses will be dependent on what is funded in the FY 2018 budget if the referendum passes." Therefore, there is no commitment to spend the county's portion of the meals tax on capital improvements. It could be spent on raises and benefits, which is not mentioned in the pamphlet.

A State Senator (more ...)

When asked, the schools' Office of Community Relations replied, "There are no responsive documents for this request. The School Board will discuss the specific uses of potential revenue from the meals tax as part of their regularly scheduled meetings and work sessions." Therefore there is no commitment to use the meals tax to reduce class size. The revenues could be spent on raises and benefits, which was not mentioned in the Senator's email.

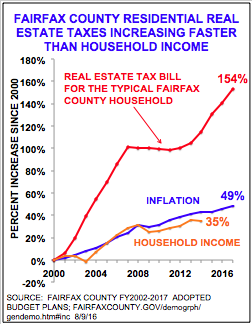

Raises and benefits are the drivers of tax increases. In fact, revenues from real estate tax increases since FY2000 have not been enough to pay raises and the increasing cost of pensions and health insurance, which is why services were cut and class sizes increased.

Sales Tax (more ...)

Dulles Toll Road (more ...)

I66 Tolls (more ...)

Business Taxes (more ...)

This will not even pay for one year's compensation increases.

County and school compensation increases (raises and the increased cost of benefits) totaled $112M last year (FY2016), $133M this year (FY2017), and are projected to cost $198M next year (FY2018). Next year's projected school budget does not propose using the meals tax to reduce class size.

In the years following the meals tax, annual budget crises, service cuts, and 5.5% real estate tax increases will continue in order to pay for across-the-board 3.5% raises, pensions with retirement at 55, and Cadillac health plans for 34,000+ county and school employees.Raises (more ...)

County and school compensation is generous. Between FY2000 and FY2016 the average annual raise for all county and school employees was about 4%. Pensions allow retirement at age 55 with 75% of salary, and employees have Cadillac health insurance. For the 2015-2016 school year, Fairfax County Public Schools reviewed 15,102 applications for 1,477 teacher job openings. In 2015 the county had 139,618 applicants for 2,601 job openings.

It is too expensive to pay all employees the premium required to retain the best employees. The Fairfax County Board of Supervisors and School Board should use bonuses or merit pay to attract and retain the best employees.

Pensions (more ...)

Health Insurance (more ...)

In FY2000 benefits were 27% of salary; now they are 46% of salary.